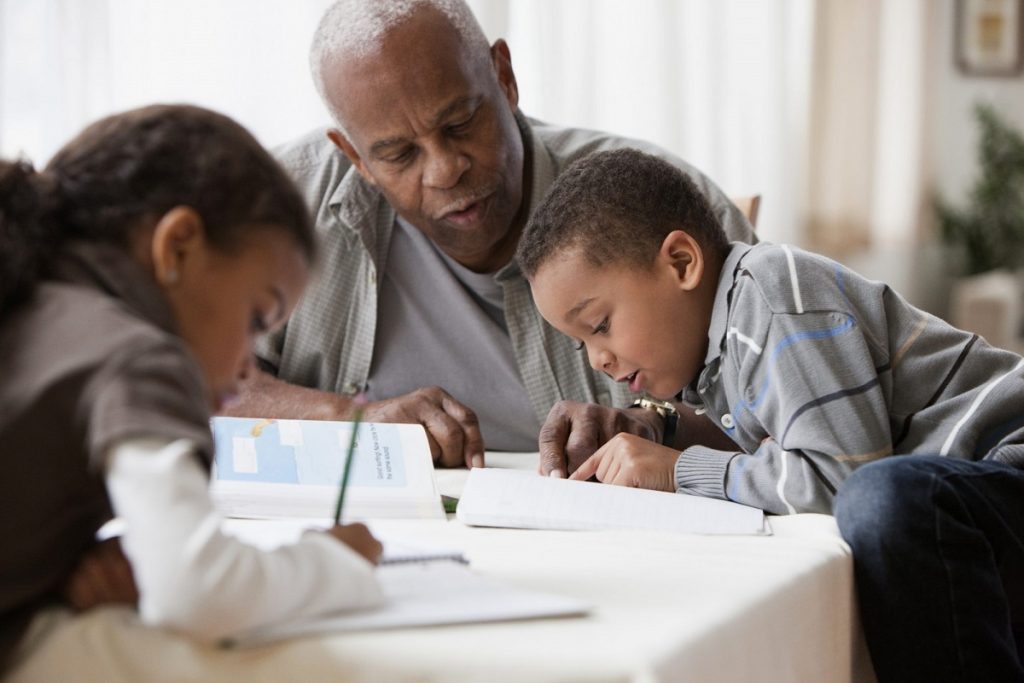

How to Finance a Dallas Home Loan for Multigenerational Living

Have you noticed a growing trend in the Dallas Fort Worth area of two or more generations coming together to live in a single property? This could mean parents living with their adult children, adult grandchildren living with grandparents, adult children living with parents, or any combination of generations sharing a residence. This situation comes…

Read more