Prequalify vs Preapproval: First Steps in the Home Buying Process

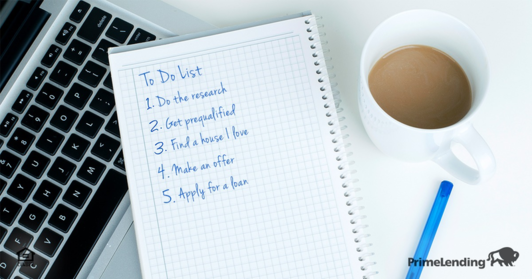

Prequalify¹ When You Are Ready to Buy a House There are two items to consider when deciding how much to spend on a home purchase: what you are comfortable with spending, and what mortgage payments your mortgage lender deems you can afford. If you want to prequalify for a mortgage, a trusted mortgage consultant like Jeff Berman “The Mortgage…

Read more